Sometimes you spend way too much at Target. When it comes to budgeting, things can and do happen. This allows you to save for these types of expenses little by little each month, so when they do occur, you already have that much money put away so you can pay for them. This rule aims to help you anticipate not just your monthly expenses, but other costs that might pop up throughout the year, like your car insurance premium or your yearly Amazon Prime fee. So, you allocate every single dollar you have set aside for your monthly budget to a specific purpose, including any amount you plan to save. The reason behind this rule is that YNAB wants the unemployment rate for your dollars to be 0%. With YNAB, every dollar you have gets a specific job, like paying a utility bill or being earmarked for grocery shopping. YNAB employs a budgeting system that is based on what they call the “Four Rules.”

Mint com vs you need a budget how to#

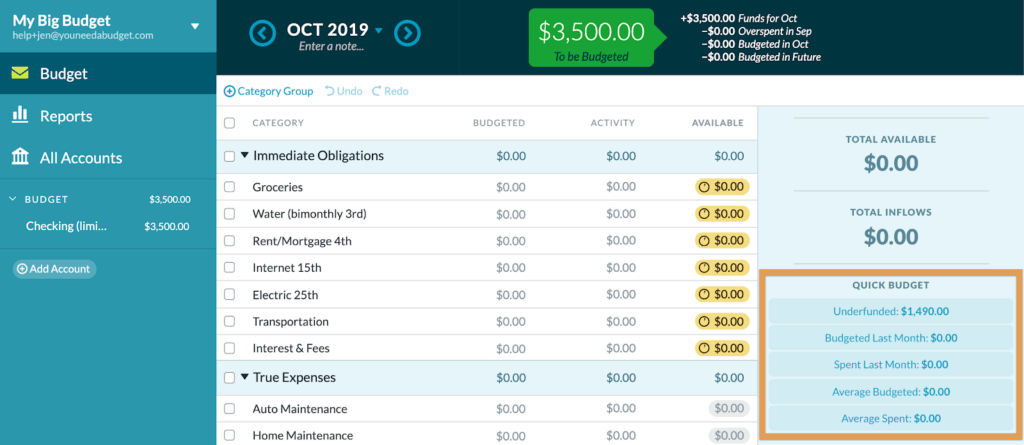

The Investopedia powers that be came to this conclusion based on YNAB’s flexibility, the many features and tools it offers its users, and the fact that it helps you take control of your money by teaching you how to better manage your finances.īut, is YNAB the best budgeting software out there? Let’s explore its offerings and find out. YNABĪccording to Investopedia, in their article “The 8 Best Budgeting Software of 2021,” YNAB is the best budgeting software currently on the market. While there are tons of different budgeting software programs on the market, I’m going to dedicate this post to comparing two popular budgeting apps: You Need A Budget (also known as YNAB) and Intuit’s Mint. And, if you’re reading this post, spending less money is probably a huge goal of yours.Īdditionally, depending on the budgeting tool you use, you can typically set up both long-term and short-term financial goals, which is great if you are looking to set aside a certain amount of money to save each month or you want to pay off a credit card or loan. For those on a budget, investing in a budgeting software program can be quite helpful because it not only helps you develop your budget, but it can also help you actually stick to it as well, which to be honest, is the real battle when it comes to budgeting.Īnother great thing about using a budgeting software is that some of the programs out there can provide you with the guidance you need to spend less money.

0 kommentar(er)

0 kommentar(er)